Synopsis:

Agri-insurers are tasked with the pressing issue of swiftly closing claims processing. They are challenged by fraudulent claims and need data-driven insights for accurate premium fixing and underwriting. This blog uncovers how technology like remote sensing and data analytics algorithms can help agri-insurers overcome these hurdles. It deep-dives into how Cropin solutions provide data-driven insights, help assess and validate claims, estimate potential losses, and assess risks during underwriting. This reduces claim settlement processing time and costs while improving the overall efficiency of insurance management.

Dependence on nature is the core characteristic of agriculture, making it inherently vulnerable to risks. From droughts and floods to untimely rainfall and hailstorms, farmers often encounter unpredictable weather patterns. Climate change has only intensified these challenges, increasing the frequency and severity of extreme events. Farmers who are at the receiving end are severely impacted. Crop insurance is the safety net for farmers, providing financial protection against crop losses. However, traditional claim settlement processes have often been plagued by significant challenges. These include risk assessment during the underwriting process, fraudulent claims ranging from simple exaggerations to complex schemes involving collusion, delays, inaccuracies, and a lack of transparency in the claims process.

Today, technology offers a promising solution to these challenges. By leveraging advancements in data analytics, artificial intelligence, and remote sensing, insurers can enhance the efficiency, accuracy, and transparency of the claims process.

The role of technology in agri-insurance

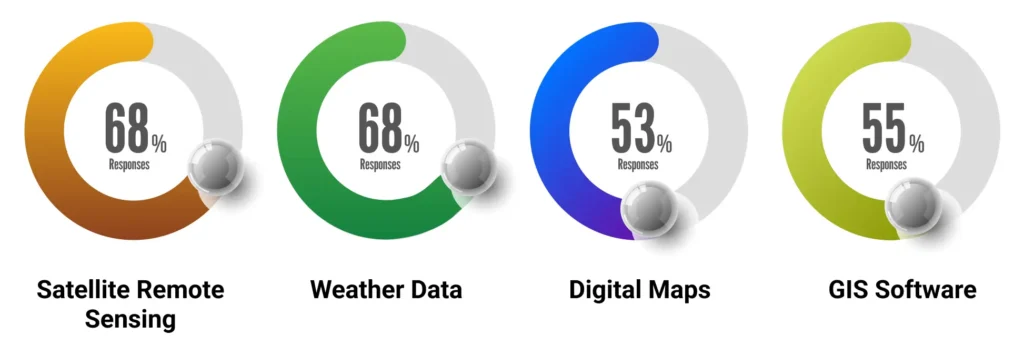

The most widely adopted technologies for underwriting and loss assessment in the agri-insurance sector, according to a survey conducted during the 2020 pandemic:

Today, developing and implementing new technologies and remote sensing tools are more crucial than ever for the agri-insurance market. These advancements can streamline processes, reduce costs, and improve the overall efficiency of insurance management.

In other words, it aids in detecting and quantifying the presence of live green vegetation based on how objects interact with light. To understand the plant’s health condition, one needs to compare the absorption and reflection values of red and NIR (near-infrared) light. Here is where NDVI comes into the picture.

Key technologies and their benefits:

-

Satellite imagery for data collection:

High-resolution satellite images allow you to capture valuable real-time data on farms/crops. For this, vegetation indices like the Normalized Difference Vegetation Index (NDVI), normalized difference red edge index (NDRE), Soil-Adjusted Vegetation Index (SAVI), Enhanced Vegetation Index (EVI), and Land Surface Water Index (LSWI), etc. are leveraged. -

AI and Machine Learning models for data analytics:

Advanced AI/ML models analyze vegetation indices in combination with other datasets to predict crop progression, identify and assess potential risks, detect early signs of crop damage, and more. -

Remote monitoring and verification:

Satellite imagery, drones, and IoT sensors enable real-time monitoring of crop health, soil conditions, and other agricultural parameters, facilitating damage assessment and claim verification.

By leveraging AI-powered algorithms to analyze satellite imagery, drone footage, and sensor data, insurers can automatically assess the extent of crop damage, validate claims, and estimate potential losses. This significantly reduces the time spent on manual inspections and claim settlement processing. As an example, let’s deep dive into how technology is leveraged in flood assessment.

Leveraging technology for flood assessment in agri-insurance

Flood, defined as the “rising or overflowing of a body of water, especially onto normally dry land,” is classified into two basic types by the United States Geological Survey (USGS 2021):

- Flash floods (recent flash floods in Chamoli district in Uttarakhand)

- River flooding (incessant rains during the monsoon season of 2024 in Kerala)

Additionally, secondary effects of natural disasters like storm surge – cyclones/hurricanes (Cyclone Nivar) and tsunamis (tsunami in Japan in 2011) also cause flooding.

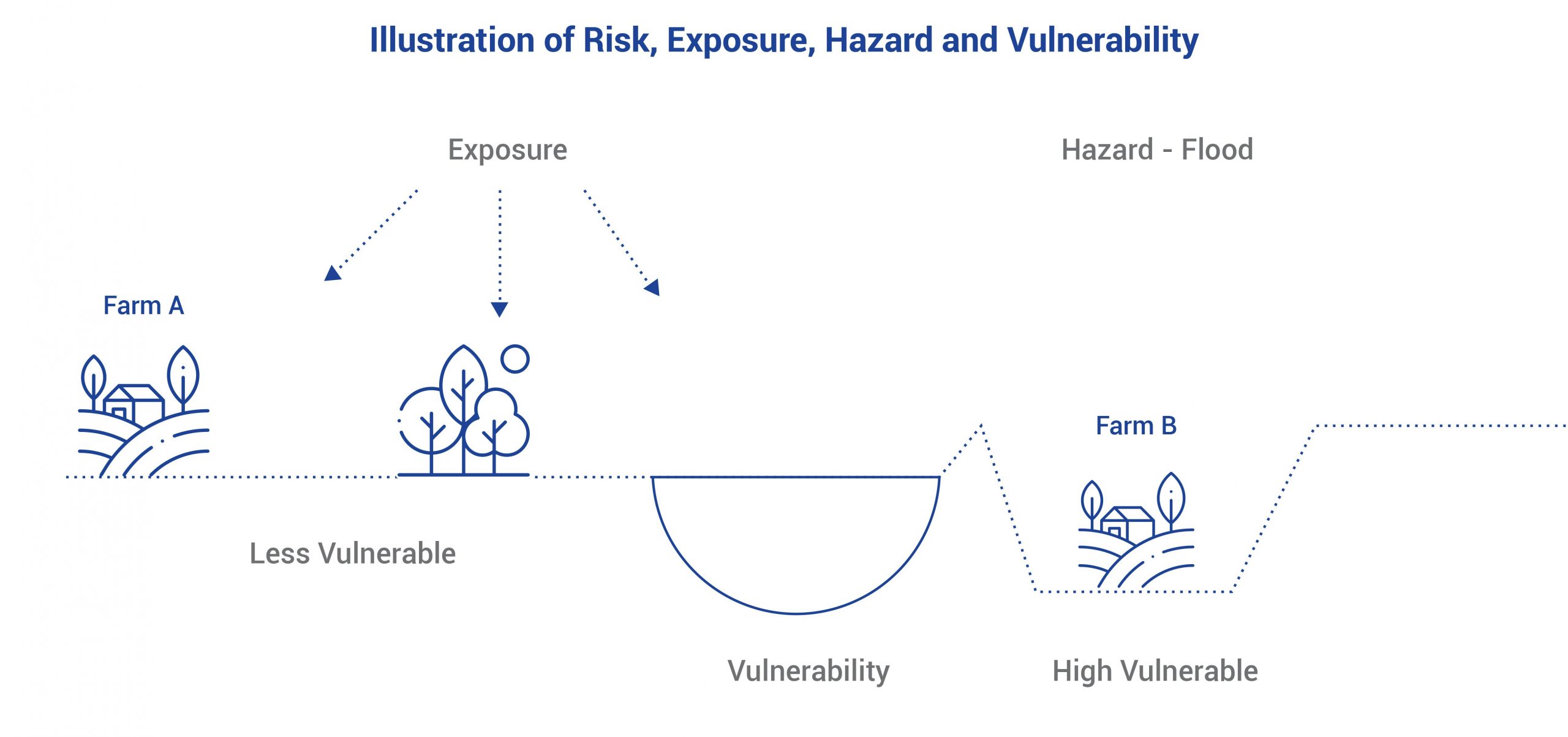

Risk management

Risk in insurance considers the impact of natural disasters like floods. It is directly proportional to

- Exposure of the asset – farms, buildings

- Probability of hazard -flood occurrence every one in 10 years versus one in 100 years

- Vulnerability of assets to damage

In the image, Farm A is farther from the river, has lower elevation and natural protection (e.g., trees), and therefore lower vulnerability to flooding. Meanwhile, Farm B, closer to the river, has a higher elevation, lacks natural protection, and hence has a higher vulnerability to flooding. Farms with higher exposure and vulnerability are at higher risk and typically have higher crop insurance premiums to compensate for the increased risk. Based on the evaluation of crop type, location, cultivation practices, historical data, and more, underwriters determine the level of risk associated with the insured crop and set appropriate premium rates. Underwriting is crucial for ensuring that insurance premiums reflect the actual risk involved and that the insurer can adequately cover potential losses. Farmers can pay a relatively small premium to receive substantial compensation in the event of unforeseen damages.

Flood mapping with satellites

Satellite imagery, even during cloud cover, is vital in flood assessment. Microwave data from satellites like Sentinel-1, with a spatial resolution of 10 m operating in the C band range of the microwave region of the electromagnetic spectrum, can penetrate clouds to provide a complete picture.

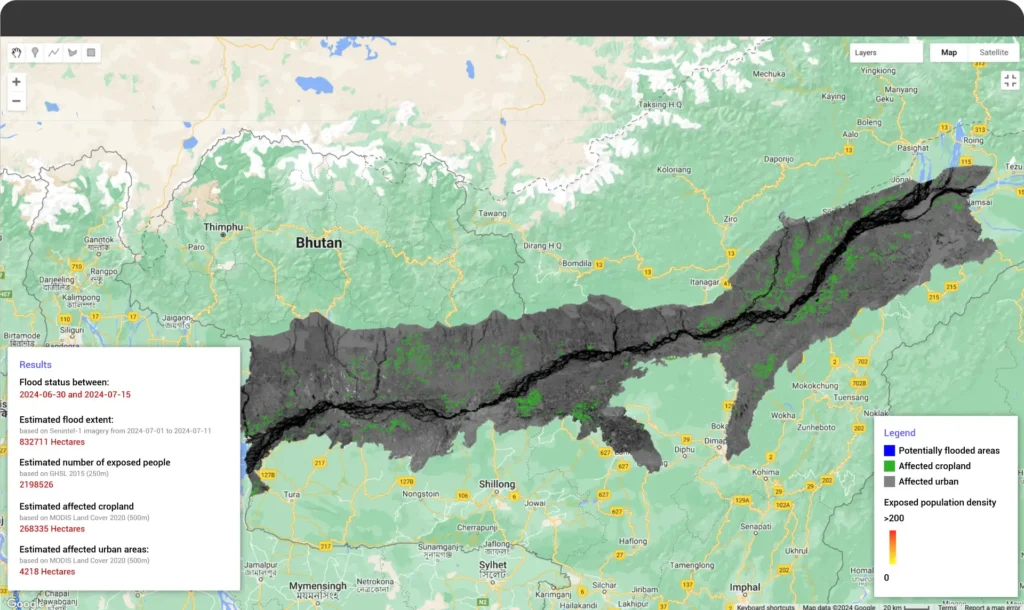

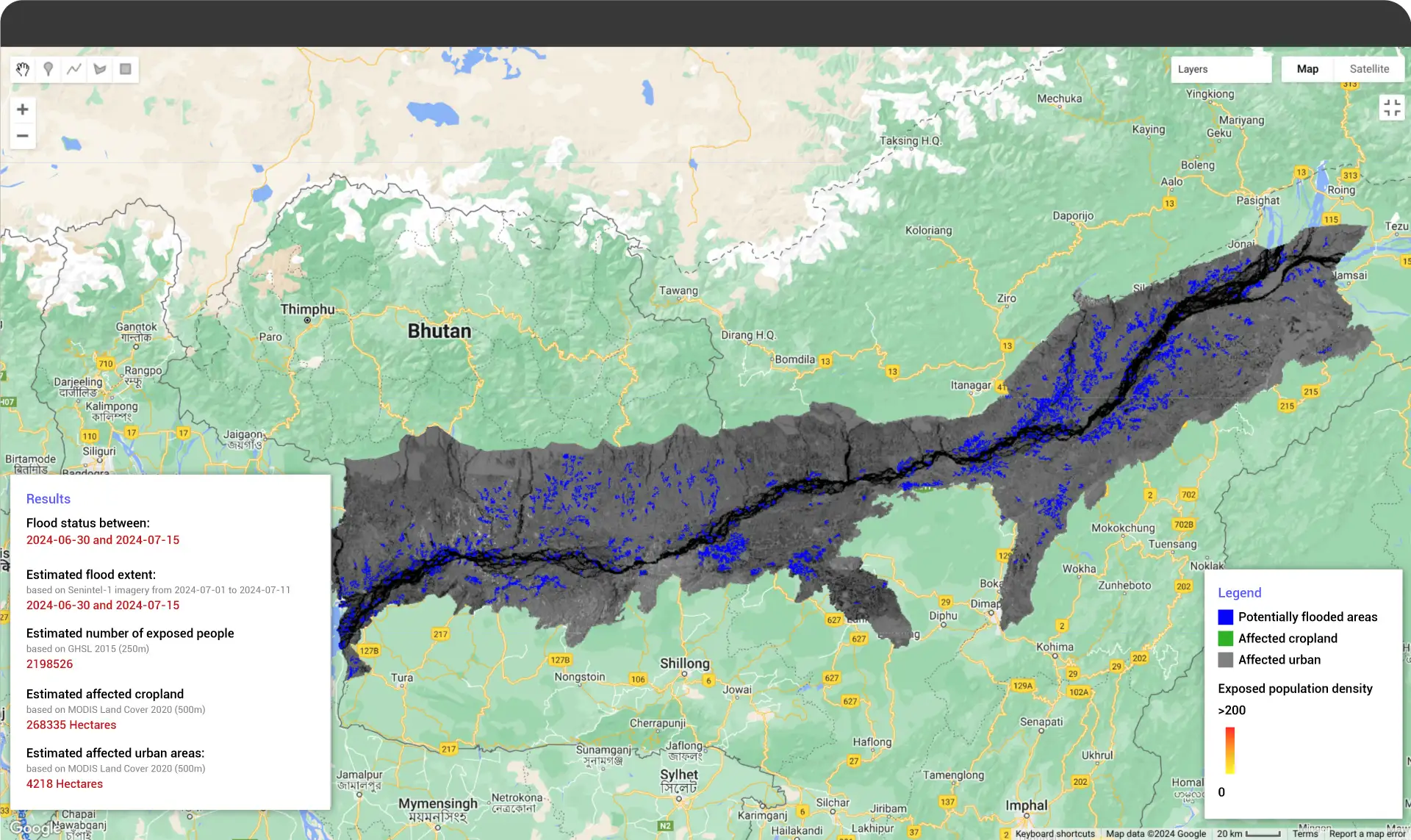

Case study: 2024 Assam floods

A recent study tool (July 2024) used freely available data to map the Assam floods. It leveraged pre- and post-flood images to detect changes in surface water. The floods’ impact on the population was assessed using the Global Human Settlement Layer and that on agriculture, and urban areas using MODIS Land Cover.

Impact Assessment: Remote sensing tools allow insurers to rapidly assess damage and estimate its extent, fast-tracking preliminary assessments of insured assets. Combined with on-ground verification, it helps quantify flood risk and guide resource allocation for insurers and government agencies.

All the districts in the vicinity of the river Brahmaputra in Assam were chosen for analysis to estimate flood damage in July 2024. As shown in the visualizations:

- Estimated flood extent area – 0.83 million hectares

- Impacted area -0.26 million hectares of cropland

- Impacted population – 2.19 million people

Figure 1: Potentially flooded area

Figure 2: Affected cropland

Disclaimer: This analysis is for technology demonstration purposes only (data as of July 26, 2024). The Assam flood situation is ongoing and requires further monitoring.

Transforming agri-insurance with Cropin

Cropin’s technology streamlines the agri-insurance process from start to finish. The robust framework combines deep learning AI/ML models, proprietary crop knowledge graphs, and satellite imagery data. Trained on vast labeled datasets to improve accuracy, these models provide actionable crop insights.

First, satellite images are captured for the region of interest, and cloud masking and interpolation are applied. This data, comprising multiple vegetation indices like NDVI, NDRE, SAVI, EVI, LSWI, etc., is overlaid with other relevant datasets, such as weather data and proprietary crop knowledge graphs, and analyzed by our contextualized AI/ML models for a comprehensive understanding. After post-processing and auditing, the extracted agri-data is visualized on the intuitive platform as map-based dashboards.

-

Crop identification model:

Identifies crop varieties leveraging Cropin’s proprietary crop knowledge graph spanning 10,000 crop varieties and advanced algorithms for accurate crop identification. It also leverages automated pipelines for data generation and quality assurance. -

Yield estimation model:

Overlays weather data, crop-agnostic information, and phenology derivatives from Sentinel-2 and Landsat 8/9, with zone sampling data for improved accuracy of yield predictions. -

Crop acreage:

Our dynamic LULC models use granular insights at a 10×10 meter resolution to derive accurate crop acreage. -

Rigorous validation:

Ensures validated data is provided for the area under cultivation, crop varieties sown, growth progression, health, and potential risks.

Once a claim is filed, regional intelligence from Cropin can rapidly assess the extent of damage, validate claims, and estimate potential losses, significantly reducing the time required for manual inspections and claim settlement. With this knowledge, insurers can control fake claims, such as filing claims for non-existent crops, submitting false records, exaggerating crop losses, and staging fake weather disasters.

Unlock smarter underwriting with Cropin Sage

Cropin Sage, powered by Google Gemini, is a cutting-edge platform that offers comprehensive agri-food information and predictive insights. Leveraging both analytical and generative AI, Cropin Sage can answer your agriculture-related questions with precision and speed. Simply ask your questions in natural language. Cropin Sage will leverage its powerful AI capabilities to translate them into SQL (Structured Query Language) queries, access the vast array of declared datasets structured by Cropin, and provide dynamic visualizations of the results. This user-friendly interface allows you to quickly obtain information on historical and real-time weather, potential pest scenarios, and future yield estimations. By harnessing the power of Cropin Sage, insurers can make informed decisions regarding fixing premiums and underwriting risks, benefiting from the platform’s accuracy, efficiency, and comprehensive data coverage.

Enhance agri-insurance with Cropin solutions

-

Efficient data collection:

Non-invasive satellite technology streamlines data collection. This can further be supplemented by ground truth validation. -

Acreage estimation and crop variety identification:

Accurately identifies sown areas using dynamic land use land cover (LULC) analysis. Utilizes proprietary crop knowledge covering over 10,000 crop varieties to identify crops at the varietal level. -

Crop health and growth progression monitoring:

Our deep-learning models track crop health and growth progression using vegetation indices like NDVI, NDRE, EVI, LSWI, and more. -

Yield estimation:

Cropin’s zone sampling and advanced yield estimation models increase the accuracy of crop yield estimates, aiding risk assessment and premium calculation. -

Rapid impact assessment:

Fast-tracks identification of flooded areas and impacted farmers for streamlined claim processing. -

Fraud detection:

By providing reliable information on crop types, growth stages, and health, Cropin helps insurers detect fraudulent claims and ensure accuracy. As a single source of truth, Cropin’s data validates claims and maintains integrity. -

Near real-time monitoring:

Insurers can monitor farmlands, assess crop growth and health, and identify and assess the impact of flood, pest, drought, etc, on yield. -

Premium and underwriting:

The Cropin Cloud platform can help insurers refine premium calculations and underwriting processes based on near real-time data and risk assessments. -

Cost-effectiveness:

Remote monitoring and agri-intelligence can automate many aspects of the claims process. Insurers can improve the affordability of premiums and reduce operational costs.

In conclusion, by leveraging the advanced Cropin solution, insurers are empowered to make informed decisions, control fraudulent claims, and improve the overall efficiency of agri-insurance processes. It empowers insurers to better assess risk, tailor policies, streamline claims, and provide superior service to farmers. From identifying flood hazard zones to evaluating crop health and predicting yields, Cropin’s solutions offer a comprehensive approach to enhancing efficiency and accuracy in the agri-insurance sector. With Cropin Sage, all you have to do is “Ask the right questions”.

Frequently asked questions (FAQs)

What is the role of insurance in agriculture?

Agriculture is a risk-prone industry, vulnerable to various environmental factors that can significantly impact crop yields and profitability. Insurance plays a vital role in mitigating the financial risks associated with crop losses, providing farmers with a safety net against unforeseen events.

Key roles of insurance in agriculture:

Protection against unforeseen events: Covers a wide range of risks, including natural disasters, pests, diseases, and other factors that can damage crops or livestock.

Financial stability: Provides compensation for losses, helping farmers maintain income and avoid bankruptcy.

Improved access to credit: Lenders may be more willing to provide loans to insured farmers.

Risk management: Encourages farmers to adopt better risk management practices.

Economic development: Contributes to the overall stability and growth of the agricultural sector.

Overall, insurance is an essential tool for farmers to manage risk, protect their livelihoods, and ensure the sustainability of their agricultural businesses.

What is the role of AI in agri-insurance?

Artificial intelligence (AI) has the potential to transform the agri-insurance sector by offering innovative solutions to traditional challenges.

AI algorithms can enhance risk assessment by analyzing vast datasets to predict future risks, such as crop yields, disease outbreaks, and natural disasters. Their data-driven insights provide valuable, accurate inputs for pricing models. AI models can help with risk profiling to optimize portfolio management by identifying high-risk areas, developing targeted risk management strategies, and effectively allocating resources.It can improve claim processing through remote monitoring to assess crop damage, identify fraudulent claims, and reduce losses for insurers. The tool streamlines operations and fast-tracks claim settlement, thereby improving customer satisfaction. AI-powered chatbots can provide farmers with personalized advice and recommendations.

By leveraging AI, insurers can improve risk assessment, streamline operations, enhance customer experience, and ultimately achieve greater profitability. The digital platforms offer seamless policy purchases, claims filing, and communication.

What are the benefits of crop insurance?

Agriculture is a risky business, facing unpredictable weather, pests, and diseases threatening harvests. Crop insurance provides a vital safety net, protecting farmers against financial losses caused by these unforeseen events. Crop insurance provides farmers with a secure income even during adverse conditions by ensuring compensation for lost or damaged crops. Additionally, as agri-income is intermittent, farmers need operating lines of credit to invest in their farms. Crop insurance can improve access to credit, as lenders often require it as collateral. This makes crop insurance an essential tool for farmers to navigate the challenges of agriculture and build sustainable businesses.

How can BFSI use agtech to create insurance policies for farmers?

BFSI (Banking, Financial Services, and Insurance) institutions can leverage agtech to create innovative insurance policies for farmers. AI algorithms can assess crop health, weather patterns, and soil conditions for accurate risk profiles. Based on the evaluation of crop type, location, cultivation practices, historical data, and more, underwriters can determine the level of risk associated with the insured crop and set appropriate premium rates that are competitive and fair to farmers. Insurers can create new insurance products tailored to specific agricultural risks, such as weather index or parametric insurance. They can also use agtech to design bundled insurance solutions combining crop, livestock, and property insurance.

How is agtech helpful in risk mitigation for BFSI?

Agtech solutions can significantly enhance risk mitigation for BFSI (Banking, Financial Services, and Insurance) institutions in the agricultural sector. It provides real-time data on crop health, weather patterns, and soil conditions, enabling more precise risk assessment. AI-powered tools can forecast potential risks like crop failures, pests, and diseases. AI algorithms can provide early warnings about potential outbreaks, allowing farmers to take mitigation measures and reduce losses. Timely weather alerts can help farmers prepare for adverse conditions and minimize crop damage.