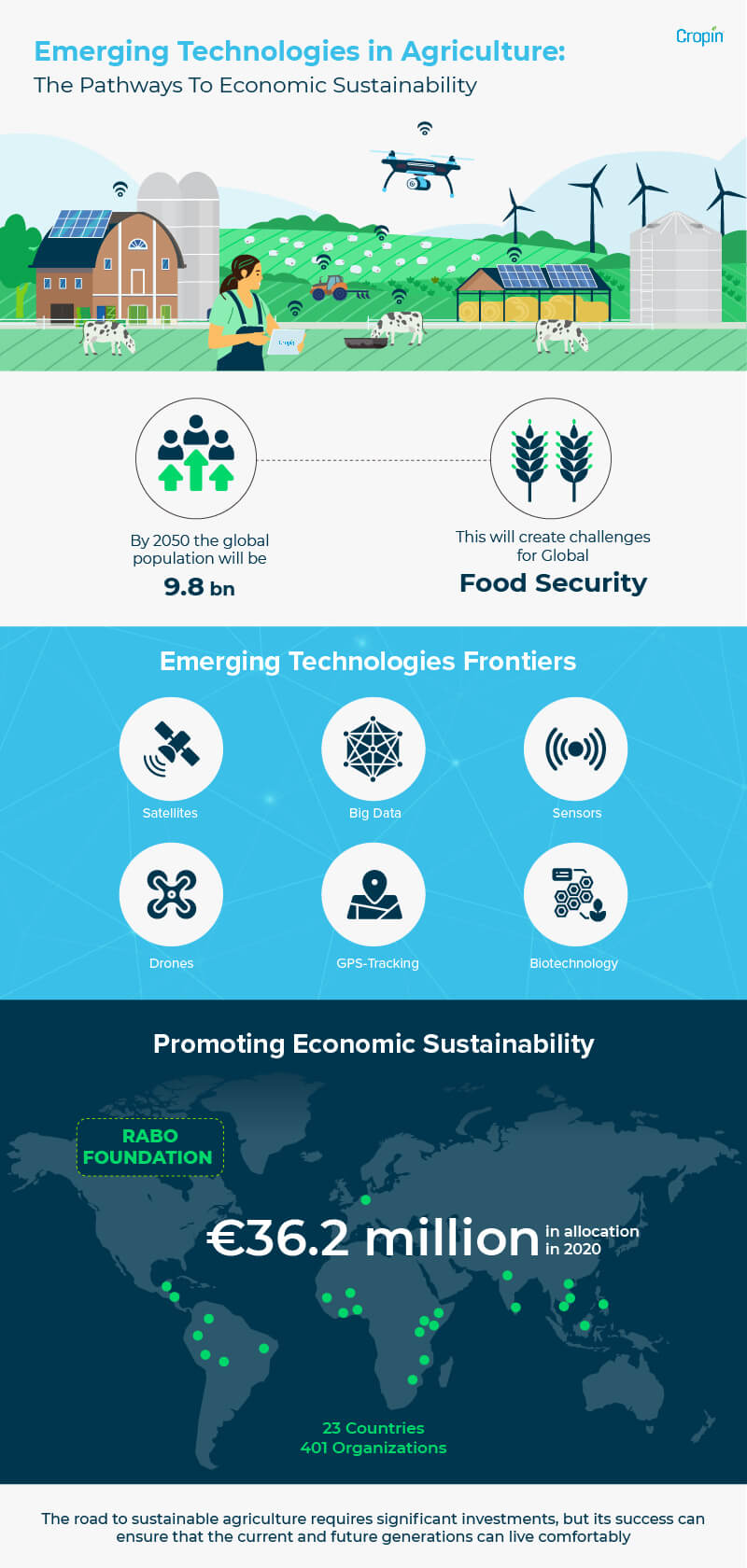

The global demand for food continues to rise and is projected to increase up to 102% to satisfy the requirements of 9 billion people by 2050. Consequently, agricultural production needs to also increase by 60%–70% to ensure the supply of raw materials for food, feed, and fiber. Ensuring a sustainable future, despite today’s sustained and intensified pressure on global resources, means that each actor in the food system needs to commit themselves to develop and enforcing practices that will reduce the use of natural resources where possible, and reuse, recycle, and repurpose them otherwise. Government entities can aid these efforts by implementing policies and strategies for efficient resource management on both national and local levels.

Adopting sustainable farming practices worldwide is contributing to the agroecosystem’s efforts to meet the world’s current food needs while also ensuring that future generations will be able to meet theirs with the limited resources that they will have. These practices also focus on holistic development that incorporates environmental, social, and economic sustainability which are the three fundamental pillars of sustainable development.

New technologies in agriculture- how do they help ensure economic sustainability?

Other technologies that hold the promise of promoting sustainability are blockchain technologies for food safety through greater transparency, controlled environmental agriculture (CEA), and biotechnology, along with 3D printing technology that allows the production of food products while saving both time and energy. Scientific research and advancements in agriculture enable farmers to utilize the best of traditional and technology-led crop production for nutritious, high-output yield while causing as little damage to the environment as possible and ensuring cost-effectiveness. With adequate and timely information at hand, even remotely-located rural farmers can adopt practices for sustainable and climate-smart agriculture that result in economic gains. Watch how Cropin made this possible.

Promoting economically sustainable farming by enhancing access to finance for smallholder farmers

One of the solutions that seek to improve an FPO’s access to capital is Rabo Foundation’s Credit Guarantee Product, which is India’s first credit enhancement product and is also estimated to be the largest-used product tailor-made for the farmer institutions’ segment in the country. The guarantee that this development finance product provides is available to any local financial institution (FI) interested in extending finance to the target group. FIs that are concerned about the risks associated with lending to this often-unexplored space can leverage the Credit Guarantee Product and benefit from Rabobank’s deep F&A sectoral knowledge and network. The product encourages FIs to initiate the flow of money and goods between farmers and FPOs and between the FPO and the market. It also helps the FIs to invest in SMEs that implement modern technologies and innovations at the initial stages, where the interest of mainstream lenders is lacking.

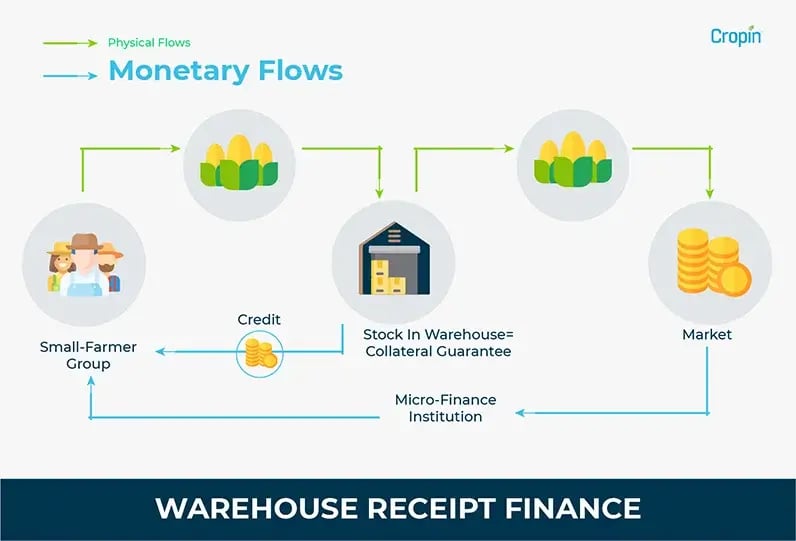

Another effective instrument that improves the incomes of smallholders is the Warehouse Receipt Finance (WRF), where stored produce is used as collateral to finance post-harvest credit needs. When implemented through effective FPOs/FPCs, it has the possibility of generating a sustainable increase in small farmers’ incomes. However, despite its effectiveness and high potential, the reach of WRF is highly restricted to smallholder farmers. To encourage WRF to the smallholder farmer groups and their institutions, Rabo Foundation has designed a 2-stage guarantee product that addresses the price risk and default risk of the FIs. Known as the Commodity Finance Guarantee, it ensures a relatively higher loan-to-value (LTV) and a guarantee to mitigate price risk in case of adverse price movement. Additionally, the product includes a provision to share 50% of the principal and interest loss with the lender. The Rabo Foundation has signed MoUs with three of the largest Indian FIs for the product’s implementation.

While, on the one hand, the Rabo Foundation is encouraging FIs to invest confidently in smallholder agriculture, it is also facilitating debt funding in the AgTech sector. The Foundation has introduced a USD 2-million debt-finance product, in collaboration with Caspian Impact Investments, that provides credit to start-ups with the potential to use advanced digitization technologies to address the issues that smallholder farmers face. The product aims to enable liquidity beyond conventional angel/venture capital as a source of high-risk capital.

Speaking of advanced technologies, satellite technology has been making a breakthrough in the finance sector over the last several years. An in-depth analysis of geodata from satellite images provides FIs with information on the crop under cultivation, its health and growth stage, and up-to-date weather data that has a direct impact on the yield. AI-enabled solutions like Cropin Intelligence also provide FIs with details on a farmer’s creditworthiness based on the farm plot’s historical, current, and predictive performance. FI’s can leverage this intelligence as an alternate source of data, along with field data on the farm’s location, type of crops being grown, and inputs used, to assess risks before providing credit. Digital technologies show immense potential to increase the time- and cost-efficiency of processing loans and also reduce NPAs.

With several new technologies being developed, tested, and implemented each day, the Rabo Foundation is conducting various pilot schemes in East Africa with partners including the Netherlands Space Office and the Geodata for Agriculture and Water (G4AW) program. In one of the projects, the Foundation combined their farm input loan to farmers’ cooperatives with insurance and advice. In 2018, the Foundation tied up with NpM (Netherlands Platform for Inclusive Finance), Bill and Melinda Gates Foundation, FMO (Dutch Entrepreneurial Development Bank), the Netherlands Space Office, and ICCO (Interchurch Coordination Committee Development Aid) to establish the Geodata for Inclusive Finance and Food (G4IFF) workstream. Its goal continues to be the improvement of risk management and the lowering of transaction costs for FIs, as well as to increase smallholder farmers’ access to financial services with the help of geodata-based information.

New technologies in agriculture for 2023 and beyond

Satellite data fuels advances in agritech

The future of farming is closely tied to cloud computing, and it has become so essential to agriculture that it is hard to imagine how the industry would function without it. Cloud computing allows agribusinesses to manage multiple technology solutions efficiently, vast amounts of data, predictive intelligence models, and other proprietary business intelligence tools under a single platform, helping to make important farming and business decisions. A specialized agriculture cloud platform can significantly reduce the time it takes for technology investments to pay off, lower barriers to innovation within the agriculture ecosystem, and bring together the capabilities needed to address major challenges. Many companies in the agriculture sector spend a lot of time and resources building fundamental technology infrastructure rather than focusing on innovation and intellectual property development in their specific areas of business. Just as railways were once a symbol of growth and prosperity, the agriculture cloud will become the central focus for new applications and developments by agtech companies, particularly as concerns about data security and privacy continue to dissipate.

Today’s technology paving the way for tomorrow’s harvest.

Editor’s note- this page was updated in February 2023 for accuracy and comprehensiveness.