Need for agri-insurance among smallholder farmers

About 84% of the 570 million farms globally belong to smallholder farmers, who cater to anywhere between 70%-80% of the world’s food needs. Smallholder farmers are constantly threatened by financial uncertainties caused by natural calamities that are beyond their control. Climate change is the biggest cause for this uncertainty. Frequent extreme weather events and growing occurrences of pests and diseases are increasing financial losses for farmers in developing countries, affecting their livelihood.

This makes smallholder farmers the most vulnerable lot who need support. How can support be provided? Well, farmers can manage risks with agricultural insurance that offers them financial protection against uncertainties causing crop failures/losses like drought, disease, excessive moisture, frost, flood, hail, wind, wildlife, etc.

Insurance benefits farmers in the following ways:

- Greater financial security

- Complete protection for the farmer and their family

- Improved access to loans from financial institutions

- Peace of mind with complete protection

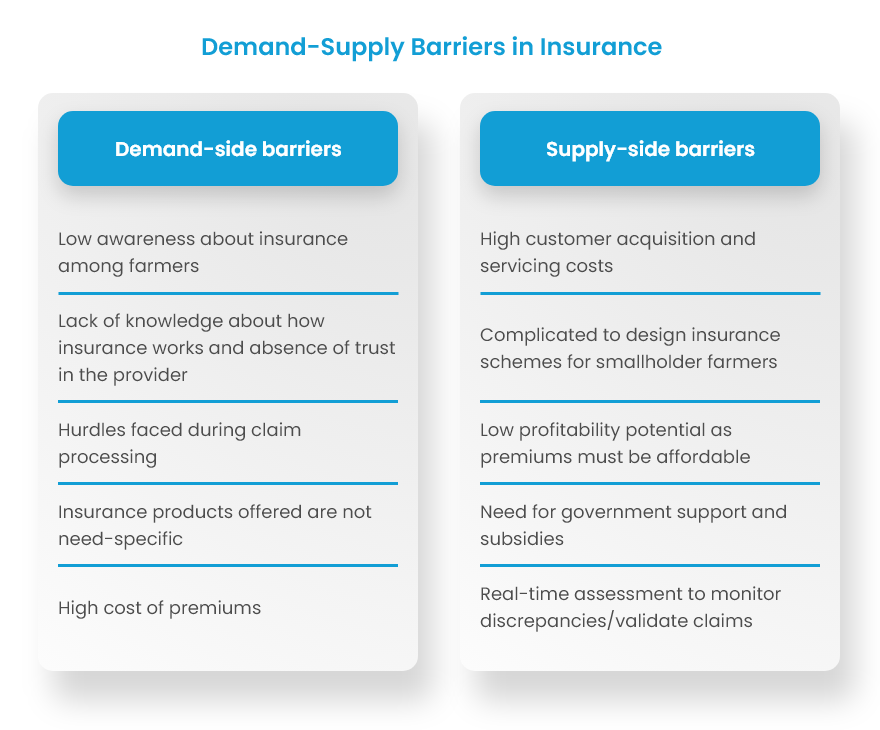

Globally, only below 20% of smallholder farmers are covered by insurance that protects them from natural calamities. The gap in insurance coverage is attributed to the demand-supply mismatch, as depicted in the figure below.

Challenges faced by agri-insurance companies

Insurance service providers overlook smallholder farmers because of inherent challenges such as the high cost of customer acquisition and servicing in remote locations. As smallholder farmers are price-sensitive, designing products for them is highly challenging and often perceived as low-profit. Also, a higher rate of catastrophic events, translating to larger and more frequent payouts, makes crop insurance a riskier proposition filled with discrepancies that require keen monitoring to avert fraud.

Various challenges encountered by the agri-insurance companies include:

- Risk variability

- Agribusiness Liability

- Farmer and claim verification

- Lack of plot-level and regional-level insights

- Need for real-time accurate crop loss assessments

- High operational costs

Insurance providers must deploy technology to break down these barriers.

How intelligent agriculture cloud can help insurance providers

Digitalization of agriculture covers a broad range of solutions from the internet, mobile connectivity, internet of things (IoT), sensors, robots and drones, digital services and apps, ground-based sensors, and satellite imagery for remote monitoring to analytics and artificial intelligence/machine learning (AI/ML) platforms that enhance transparency and offer data-driven insights to increase efficacy of the agricultural value chain.

Governments and agricultural bodies use crop cutting experiments (CCEs) to predict the yield of a crop or region during a specific cultivation cycle through random farm selection to assess various parameters and extrapolate it to predict average yield. The insurance industry uses this traditional CCE (which is both resource- and time-intensive) to settle claim covers. The technology intervention can change CCE into an efficient exercise with better accuracy and timely yield estimation.

Digitalization provides accurate field data that makes sample selection relevant, precise, and logical; and AI/ML analyzes data points to provide scientific, scalable, and accurate insights for future processing. Accurate yield analysis reduces claims settlement time, while accurate data-driven reports solve the problem of fraudulent claims or erroneous settlements.

Agri-insurance providers can leverage data insights provided by intelligent agriculture cloud platform on historical yields, area yield per farmer and real-time data collated from each farm at the end of a season to develop crop insurance schemes and products. By deploying technology, they can gain from real-time credit risk assessment and satellite imagery to monitor discrepancies and risks, and predictive intelligence at region, plot, and crop level for crop protection.

Most often, rural weather data is patchy or even unavailable. Using an intelligent farm monitoring solution, insurers gain access to satellite imagery and near real-time weather data, enabling improved rainfall monitoring and accurate claim settlements for covered farmers. Technology helps insurance providers adjust premiums, validate claims, and eliminate chances of fraud.

The Cropin advantage

Cropin Cloud, the first purpose-built agriculture cloud platform, provides AI-enabled agile agricultural intelligence. It integrates multiple solutions that support digitalization, consolidates data pipelines for improved analytics, and extends unified access to AI/ML models. The revolutionary power of Cropin Cloud offers agri-insurance companies digital KYC, the option to remotely monitor farmlands, pinpoint affected crops, access near real-time weather reports, pest and disease alerts, and data-driven intelligence insights. Using this, agri-insurance companies can adjust premiums in real-time, reduce claim process time, and minimize the cost of operations by automating disbursal, identifying malpractices, and minimizing fraud.

Case in point

Cropin partnered with the Government of India in the world’s largest crop insurance program Pradhan Mantri Fasal Bima Yojana (PMFBY). The project enabled speedy resolution of claims. The program reduced the time to conduct CCE by 48%, saved the government millions of dollars, and impacted over 2 million farmers.

Click here to download the case study.