- 1 1. Data-Driven Decisions: The Cornerstone of Future Growth

- 2 2. AI, IoT, and Automation: Powering the Agricultural Ecosystem

- 3 3. Deepening Farmer Engagement: Building Trust and Transparency

- 4 Embracing Change Management and Continuous Improvement

- 5 The Seed Industry: Embracing Digitalization for a Sustainable Future

- 6 Sowing Seeds of Digitalization

- 7 Digitalizing the Seed Value Chain:

- 8 Data as a Strategic Asset:

- 9 The Rise of Advanced Technologies:

- 10 Food Processing Sector: Embracing Digital Transformation for Future Growth

- 11 Digitalization: The Engine of Growth

- 12 The Digital Future of Crop Protection: Embracing Technology for a Sustainable and Efficient Industry

Synopsis: This report highlights the importance of digital transformation for the agricultural sector. It focuses on change management for three key segments: seed companies, food processors, and crop protection companies. All three groups are expected to significantly increase their use of data by 2024. Some of the common challenges include building trust with farmers, developing talent with the necessary digital skills, and building a culture of continuous improvement. The blog discusses challenges specific to each segment and the impact of digitization.

- 1 1. Data-Driven Decisions: The Cornerstone of Future Growth

- 2 2. AI, IoT, and Automation: Powering the Agricultural Ecosystem

- 3 3. Deepening Farmer Engagement: Building Trust and Transparency

- 4 Embracing Change Management and Continuous Improvement

- 5 The Seed Industry: Embracing Digitalization for a Sustainable Future

- 6 Sowing Seeds of Digitalization

- 7 Digitalizing the Seed Value Chain:

- 8 Data as a Strategic Asset:

- 9 The Rise of Advanced Technologies:

- 10 Food Processing Sector: Embracing Digital Transformation for Future Growth

- 11 Digitalization: The Engine of Growth

- 12 The Digital Future of Crop Protection: Embracing Technology for a Sustainable and Efficient Industry

The agricultural sector faces many challenges: rising temperatures, increasingly frequent natural disasters, a burgeoning global population demanding more food, and the ever-present need for sustainability. Digital transformation emerges as a powerful ally in this dynamic landscape, empowering small and large-holder farmers and the entire agri-business ecosystem.

Cropin undertook a comprehensive study conducted by Curious Insights to delve deeper into the current agricultural landscape. The research focused on three key players—seed production companies, food processors, and crop protection providers—and interviewed 120 influencers, CXOs, and practitioners across various regions.

The digital revolution is upon us, and the agri-industry is poised to reap its benefits. Here are the four key takeaways that resonate across all three segments:

1. Data-Driven Decisions: The Cornerstone of Future Growth

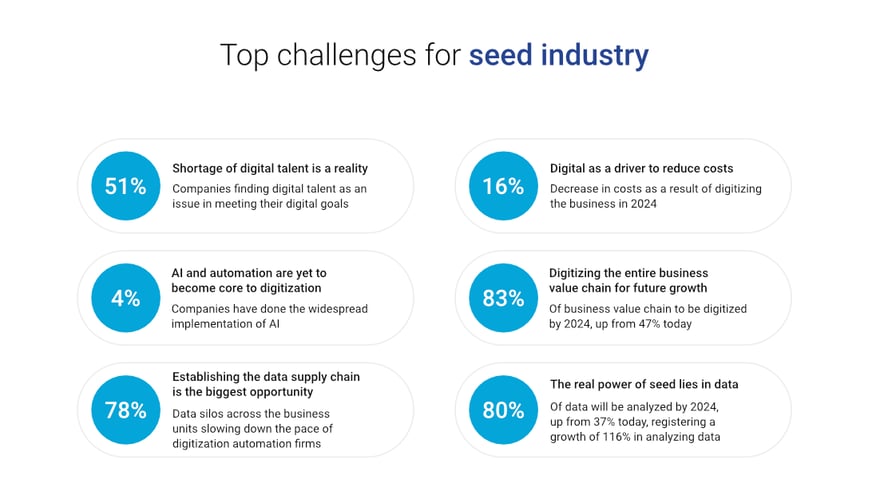

Across the board, all three sectors acknowledge digitalization and data-driven decision-making as the cornerstone of their future growth. For seed producers, digital tools can track seed origin, quality, and performance data, leading to improved breeding programs and targeted recommendations for farmers. The study revealed that the seed sector expects 83% of the value chain to be digitized by 2024.

On the other hand, food processors can leverage real-time data from sensors to optimize production processes, minimize waste, and improve food safety and quality control. An impressive 91% of the food processing business chain is expected to be digitized by 2024. Data analytics also empowers crop protection companies to predict pest and disease outbreaks, enabling targeted application of solutions and reducing environmental impact and costs. This sector anticipates an average of 90% of data to be collected and analyzed by 2024.

2. AI, IoT, and Automation: Powering the Agricultural Ecosystem

Adopting cutting-edge technologies like Artificial Intelligence (AI), the Internet of Things (IoT), and automation presents a significant opportunity for the entire agricultural ecosystem. In seed production, AI can analyze vast datasets to identify optimal breeding combinations and predict seed performance under diverse conditions, paving the way for more resilient and productive crops. However, widespread adoption within seed companies is yet to begin.

IoT-enabled devices and remote sensors can be game-changers for food processors and crop protection companies. Real-time field data on weather, soil moisture, and pest presence allows for tailored management strategies that minimize waste, optimize resource use, and ensure sustainable food production. There’s immense potential for increased adoption of these technologies.

3. Deepening Farmer Engagement: Building Trust and Transparency

Building trust and transparency with farmers emerged as a key benefit of digitization across all three segments. Notably, 62% of seed producers believe digitalization can overhaul current engagement practices and build trust with farmers. Conversely, 88% of food processors identified consistent farmer engagement as a major challenge. Similarly, 82% of crop protection respondents consider enhancing farmer engagement a primary challenge.

Embracing Change Management and Continuous Improvement

Change management is crucial for all stakeholders in the agricultural ecosystem. Seed companies, food processors, and crop protection companies must continuously adapt to evolving regulations, consumer preferences, and technological advancements to stay competitive. This necessitates a culture of continuous improvement – refining processes, implementing innovative technologies, and adapting to the changing landscape.

This Cropin-commissioned study serves as a valuable resource for understanding the current state of the agri-industry and as a benchmarking tool for stakeholders globally. By comparing their practices and strategies with the revealed industry trends, enterprises can identify areas for improvement and contribute to building a more resilient and flourishing agricultural landscape. Leveraging digitalization, data, intelligence, and automation is key to a more sustainable, efficient, and profitable agricultural future.

Let us now look at what the study revealed for each sector.

The Seed Industry: Embracing Digitalization for a Sustainable Future

According to industry estimates, the global seed market is projected to grow at a CAGR of 6.6% to reach a value of US$ 86.8 billion by 2026. Traditional methods need more transparency, slow technology adoption, and efficient processes. Digitalization offers an effective solution to tap this growing market and for a more sustainable future.

Sowing Seeds of Digitalization

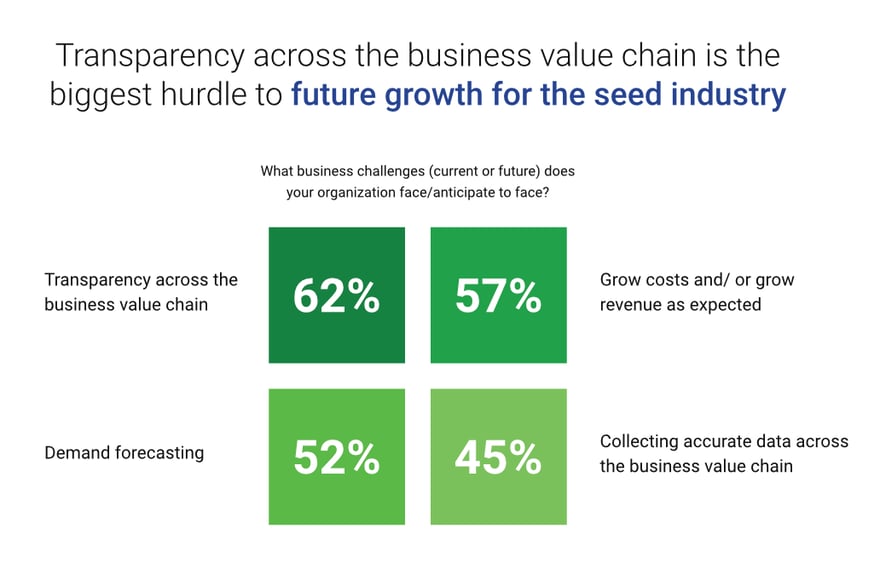

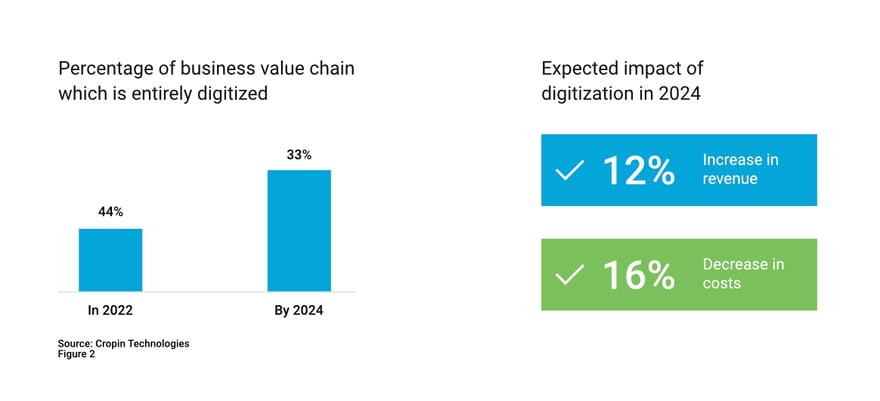

Digital transformation offers a multitude of benefits. Seed production companies are struggling with the following top three challenges, which digitalization can ease. Transparency across the business value chain is the top challenge for 62% of the participants, while 57% consider reducing costs and/ or growing revenue, followed closely by demand forecasting at 52%. Seed production companies estimate generating 12% of revenue while reducing 16% of costs with digitization by 2024.

Digitalizing the Seed Value Chain:

The survey has investigated areas where the promise of transformation lies. They are:

- R&D: Eighty percent of participants believe that leveraging digital tools can reduce R&D costs, while 72 percent feel it can accelerate trialing. The biggest benefit for 65 percent of participants is having a single-point system tracking the progress of each seed variety.

- Production: Seed companies have established ambitious goals to be achieved with digitization. The survey shows that 80% of participants aim to enhance monitoring practices to improve yield and quality, and 75% target improvement in field audit, seed demand estimation, and supply. Further, 65% of participants look to improve the ease of configuring the package of practices based on crop, variety, region, and time of year, supported by digitization efforts.

- Sales & marketing: They are looking to improve transparency and visibility into progress made for each crop/variety globally (72%), create customized sales strategies for different geographies (70%), and run farmer engagement campaigns and monitoring activity for each demo plot (68%) as the top business benefits resulting from the digitization of processes.

Data as a Strategic Asset:

Leveraging data is crucial for success in the digital age. Seed companies need to collect and analyze data throughout the seed lifecycle. Just 43% of data was digitized in 2022; it is expected to reach 82% by 2024. They strive to establish a “data supply chain” to manage data across the entire value chain and enable data-driven decision-making.

The Rise of Advanced Technologies:

While still in the early stages of adoption, AI, automation, and IoT offer significant potential for the seed industry. Examples include AI-powered platforms for customized seed recommendations and automated workflows for faster data collection and analysis. Recently, Punjab Agri Export Corporation leveraged an AI-based solution for seed potato traceability to curb the sale of counterfeit, low-quality seeds and to improve the quality of potato seeds.

Empowering Farmers:

Building trust and engaging effectively with farmers is critical for long-term success. Seed companies need to:

- Develop targeted training programs for smallholder and women farmers (currently, only 12% offer dedicated programs).

- Collaborate with farmers to ensure their integration into the knowledge chain and benefit from industry advancements.

- 90% of the participants agreed that they must overhaul their farmer engagement practices.

A Sustainable Future:

Digital transformation empowers the seed industry to:

- Increase efficiency and productivity.

- Develop sustainable and climate-resilient seed varieties.

- Empower farmers for improved livelihoods and global food security.

Embracing digitalization and prioritizing farmer engagement will guide the seed industry toward a sustainable and equitable food system.

Food Processing Sector: Embracing Digital Transformation for Future Growth

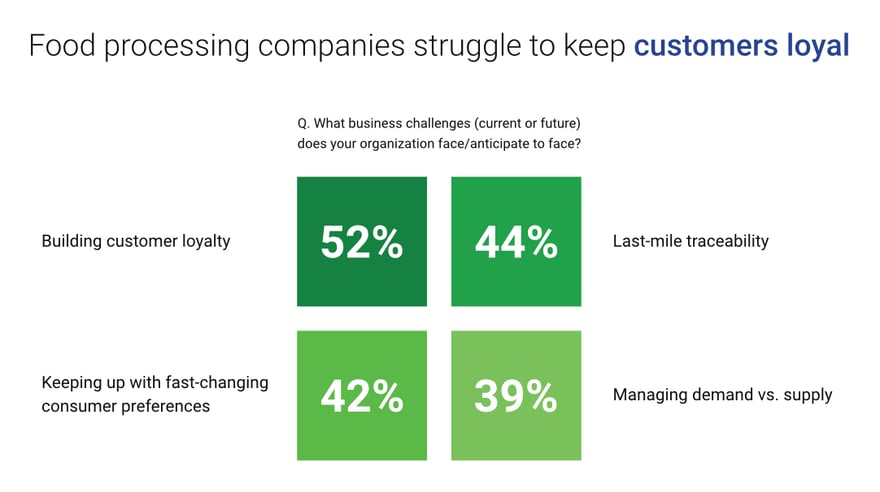

The food processing industry is rapidly evolving, driven by shifting consumer trends, population growth, and technological advancements. According to Market Future Research, the global food processing market is expected to grow at 7.60% CAGR between 2022 and 2030, reaching $134.7 billion. Companies must digitize their value chain to thrive, gaining real-time insights and enhancing transparency.

Digitalization: The Engine of Growth

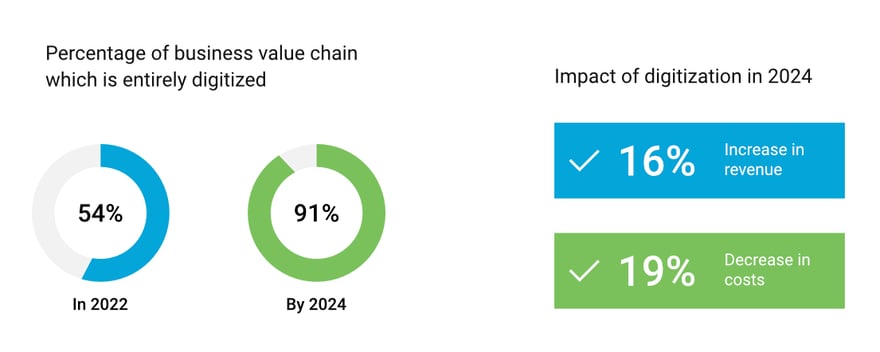

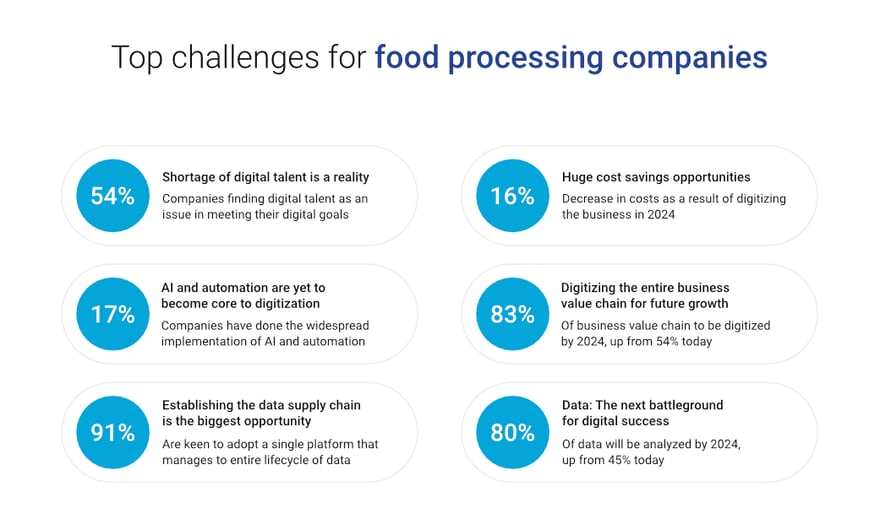

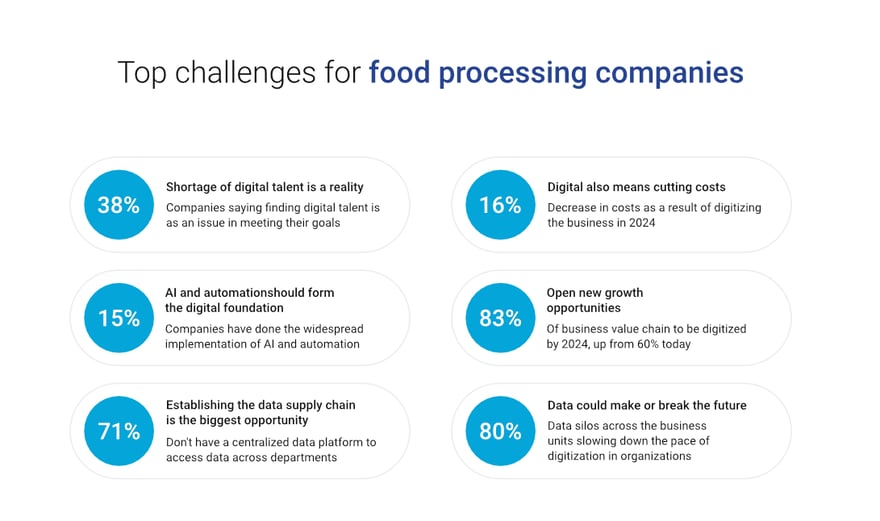

In 2022, only 54% of the consumer value chain was digitized, and the downstream chain (farm to warehouse) lags. However, this is rapidly changing, with an impressive 91% of the entire value chain expected to be digitized by 2024. Companies anticipate a 16% revenue increase and a 19% cost reduction through digitalization.

Leveraging Data Across the Value Chain:

So, what are the leading objectives that drive food producers to adopt digitalization?

- Procurement: A significant 88% have their sights firmly set on deepening farmer engagement with digital tools, and 78% look at it to improve accuracy in forecasting.

- Supply Chain: Of the supply chain respondents in the sector, 85% see challenges in end-to-end visibility, 81% in gaining consumer trust, and 78% in controlling the timing, quality, and quantity of supply to demand, fostering customer loyalty. They expect significant progress around traceability in agriculture with the implementation of digital technologies.

- Sales & Marketing: Digital investments in the downstream value chain can provide real-time insights to meet evolving consumer demands for sales & marketing. Lack of intelligence from the field, customers, retailers, and dealers is a key challenge for 81% of respondents.

From Data to Decisions:

Moving forward, data analysis is crucial for food processors. The sector analyzed 45% of data in 2022, which is expected to rise to 86% by the end of 2024. Food processors must democratize data for informed decision-making, invest in data management strategies to strengthen them and analyze customer data to understand evolving consumer demands.

The Rise of Digital Technologies:

Food processors are increasingly leveraging various technologies, including:

- Data analytics (75%)

- Process automation (68%)

- AI (53%)

- Sensors/IoT (53%)

Challenges and Considerations:

Despite the benefits of digitalization, the industry faces challenge

- Digital Talent Shortage (54%): Need to attract young talent to bridge the skill gap.

- Localization (58%): Developing solutions that cater to diverse market regulations, preferences, and needs is crucial.

- Workflow Customization: Ensuring digital solutions adapt to specific business models and processes is essential for successful implementation.

Embracing digitalization across the entire value chain is essential for food processors to stay competitive. By harnessing data, technology, and strategic partnerships, they can unlock new business value, enhance sustainability, and achieve traceability in agriculture.

The Digital Future of Crop Protection: Embracing Technology for a Sustainable and Efficient Industry

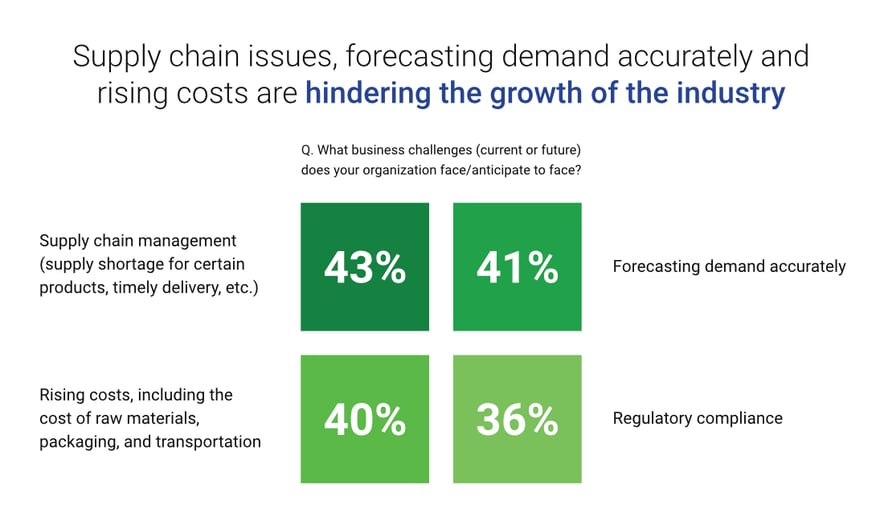

Rising food demand and climate pressures urge the crop protection industry to adapt. Traditional methods struggle with supply chain disruptions, fluctuating demand, regulatory compliance, and reactive pest management. Digitalization offers a solution.

Challenges and Pressures:

Challenges and Pressures:

- Supply chain disruptions: Respondents from the crop protection industry identified supply chain management (43%) as the biggest challenge, followed by accurate demand forecasting (41%) and rising costs (40%). Lack of visibility across the entire supply chain further exacerbates these issues, making it difficult to manage resources effectively.

- Demand forecasting complexities: The industry’s cyclical nature and fluctuating sales make accurate demand forecasting challenging. Predicting long-term trends is even more difficult, considering the constant development of new products and applications.

How do crop protection companies intend to address these challenges? The survey respondents look to technology to help.

Benefits of Digital Transformation:

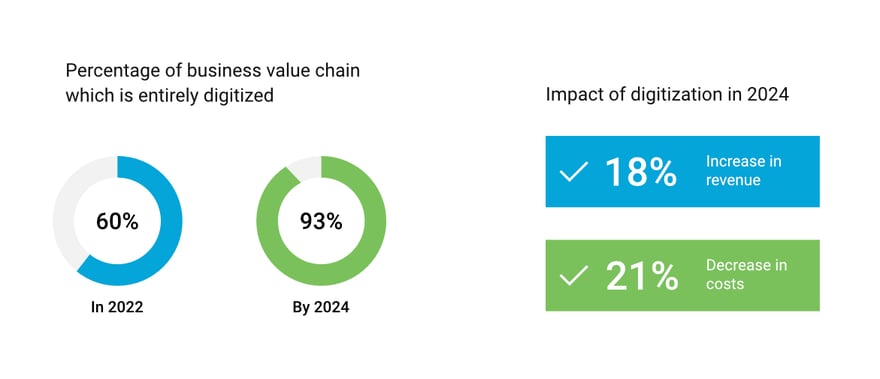

Companies expect an 18% revenue increase and a 21% cost reduction through digitalization. As digital tools enable real-time product tracking, they drive a more responsive and responsible system. Digitalization enables a proactive approach to pest management instead of a reactive one.

Digital transformation across the value chain:

Product R&D can be streamlined on integrated platforms by connecting data sources, fostering quicker development and market alignment. These can also enhance farmer-field engagement, offering data-driven insights for improved planning. Real-time intelligence from diverse data sources will empower sales and marketing teams to adapt swiftly to market changes and make informed decisions.

Data Management and Utilization:

Data is crucial for developing new and optimizing existing crop protection products. However, challenges include:

- Data management: The sheer volume of data generated by research and field trials can be overwhelming, and data silos within organizations hinder information sharing, according to 68% of respondents.

- Data analysis: In 2022, only 54% of collected data was analyzed; this is expected to increase to 90% by the end of 2024.

Companies need effective data management and analytics to unlock insights and drive informed decisions.

Emerging Technologies:

Crop protection companies are increasingly leveraging emerging technologies, including:

- Data analytics (38%)

- Automation (24%)

- Sensors/IoT (12%)

- AI (6%)

Challenges and Considerations:

- Breaking down business silos (41%) through cross-functional teams.

- Addressing the digital talent shortage (38%) through partnerships.

- Lack of workflow customizations (35%) to cater to diverse market needs.

A Sustainable Future:

Digital transformation is essential for the crop protection industry to ensure a secure and sustainable future. By leveraging technology, companies can:

- Reduce crop loss from pests and diseases.

- Improve demand forecasting.

- Manage resources effectively, minimizing environmental impact.

- Enhance food security and meet the growing global demand for food.

Conclusion:

Conclusion:

Drawing insights from our survey analysis, we propose the following recommendations for agri-industries to align with the evolving landscape of digital transformation and agri-intelligence.

- Invest in Technology to Digitalize Operations.

- Align Vendors with Your Long-term Strategic Goals.

- Prepare for the Adoption of AI, IoT, and Automation.

- Devise a Fool-Proof Change Management Strategy.